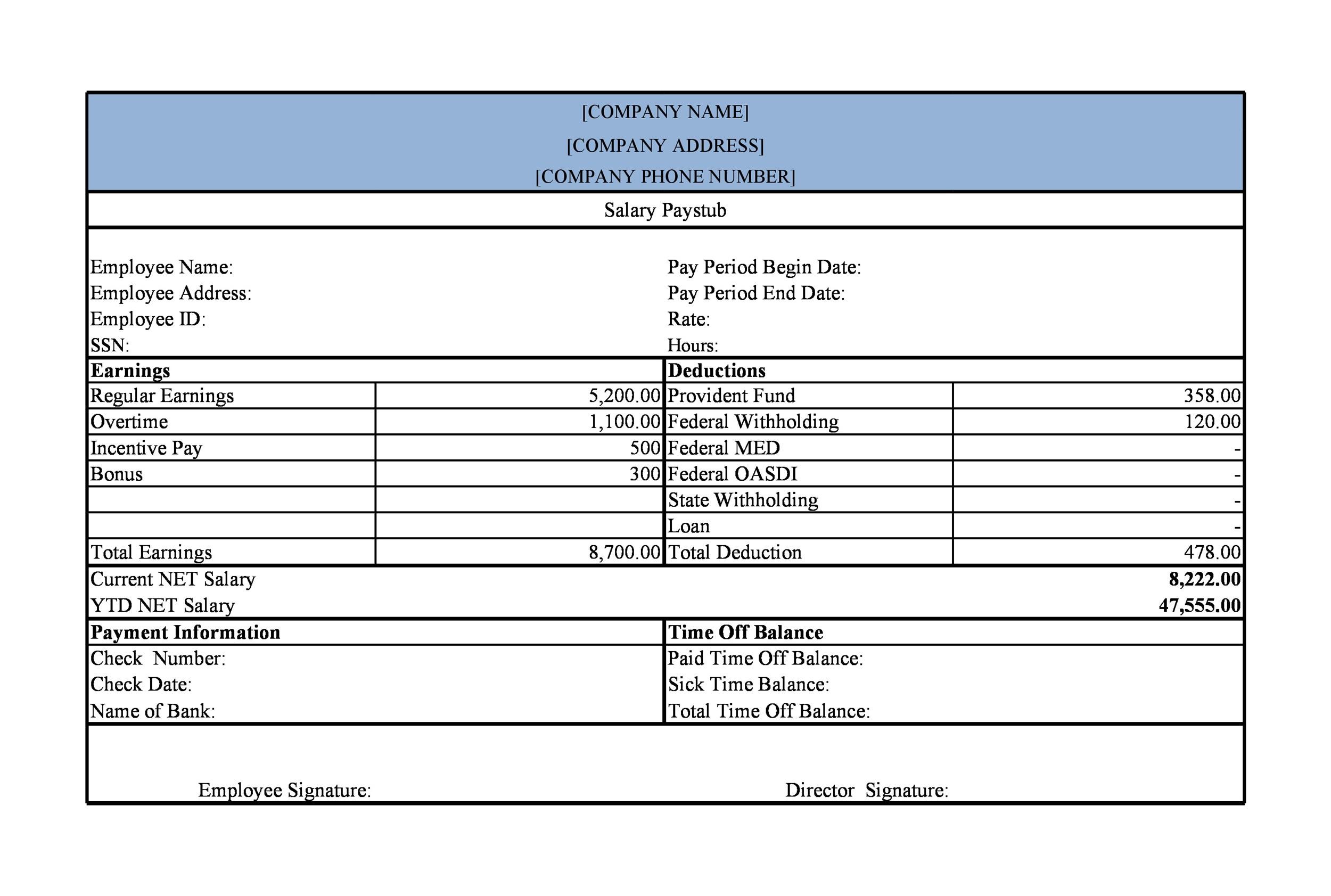

If an employer isn’t required to provide employees with pay stubs, should an employee request access, it’s good practice to allow them to review their records. Consequences for non-compliance vary, but it’s best to avoid a Department of Labor (DOL) audit. In most states, providing employees with pay stubs is a local requirement. Failure to provide copies of the payroll records entitles the employee to a $750 penalty, as well as a claim for injunctive relief and attorneys’ fees. The consequences of non-compliance vary by state, but to give an example, California state law requires employers to provide payroll records within 21 calendar days if an employee requests them. Because the FLSA requires the employer to keep such records, even if they are not required to provide paystubs, that data should be accessible and made available to the employee.” Consequences of non-compliance “Electronic pay stubs or data are sufficient in most places. A denial of a request to access that information would be highly suspicious. Anderson Law, Ltd., who practices law in California. “While FLSA does not require the pay stub statement, most states require that the information be available to the employee, but not necessarily as a paper paystub,” says Attorney Eric D. In states that don’t require employers to provide employees with a pay stub, an employee should be granted access to the payroll records maintained under the FLSA’s recordkeeping requirements. What if an employee requests a copy of their payroll record? Date of payment and the pay period covered by the payment.All additions to or deductions from the employee’s wages.Total overtime earnings for the workweek.Total daily or weekly straight-time earnings.The basis on which employee’s wages are paid.Hours worked each day and total hours worked each workweek. Time and day of the week when employee’s workweek begins.

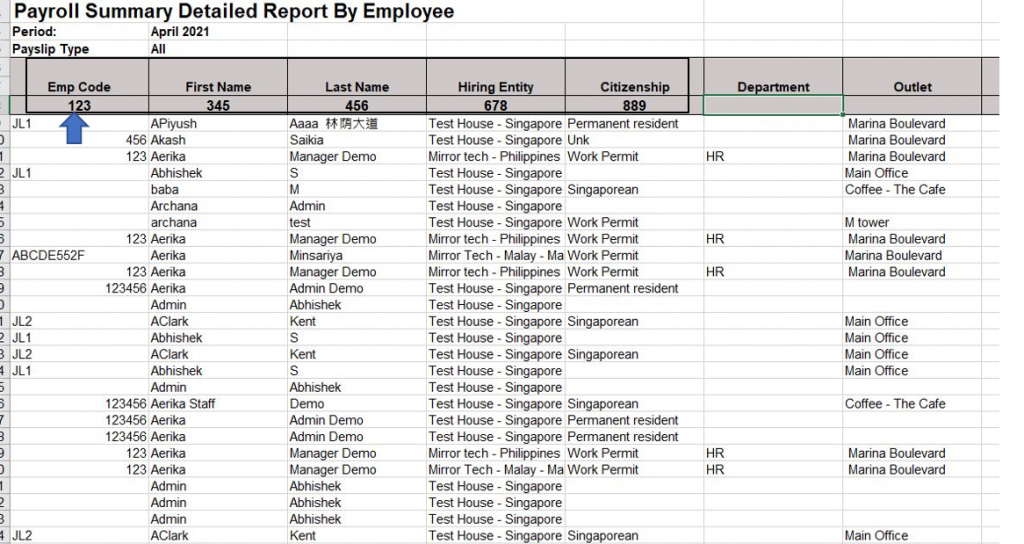

#Paperless pay employer code list full

Employee’s full name and social security number.What’s required to be included in payroll records?Īs we stated earlier, the FLSA requires that employers keep accurate records of hours worked and wages paid to employees. A total number of hours worked for hourly workers and different types of hours worked, including regular, overtime, break time, double-time, etc.Wage garnishments (such as child support).Contributions, such as to a Retirement or Pension Plan.

While an employer can provide pay stubs to employees, they are not required to. The above states have no requirements regarding pay stubs. Since pay stub requirements vary by state, we’ve compiled a list of pay stub requirements for employers in all 50 states: No requirement states Most states have their own laws requiring employers to provide access to employee pay stubs. This doesn’t mean employees don’t have a right to see their wages information, however. Still, they must keep accurate records of hours worked and wages paid to employees. Private employers and employers in federal, state, and local governments are not required by the Fair Labor Standards Act (FLSA) to provide employee pay stubs.

True or False: Federal law doesn’t require employers to provide employees with pay stubs.Īnswer: True.

0 kommentar(er)

0 kommentar(er)